Bitcoin's Bull Flag Breakout: What's Next For The World's Top Coin?

Bitcoin's technical bull flag breakout coincides with unprecedented institutional adoption, Lightning Network advances, and dollar debasement. Six catalysts suggest this rally could dwarf previous cycles.

Overview

Bitcoin's textbook bull flag breakout approaches the critical $113,000 confirmation level, coinciding with unprecedented institutional adoption creating the most compelling cryptocurrency setup since 2020. With BlackRock and Fidelity driving $20B+ in ETF assets, Lightning Network reaching critical mass with 300% growth, and Robinhood democratizing access for 23 million users, six powerful catalysts are converging to support targets of $150,000 and beyond.

This comprehensive analysis examines the technical pattern formation, institutional adoption tsunami, and fundamental drivers reshaping Bitcoin's investment landscape. We'll explore how the convergence of mainstream financial integration, payment infrastructure advances, and macroeconomic factors creates a unique setup that differs fundamentally from previous cryptocurrency cycles driven purely by speculation.

From the $113,000 breakout confirmation level to strategic portfolio implications, understanding these converging catalysts is essential for navigating what could be Bitcoin's final transition from alternative investment to mainstream financial asset. The analysis combines traditional technical analysis with emerging cryptocurrency adoption metrics and real institutional flow data.

The Setup Everyone’s Been Waiting For Just Triggered

Bitcoin just did something it hasn’t done since early 2024: broke out of a textbook bull flag formation. But here’s what makes this breakout different—it’s not happening in isolation. Six powerful catalysts are converging simultaneously, creating the most compelling Bitcoin setup in over two years.

While crypto traders obsess over chart patterns, the smart money has been quietly positioning for something bigger. BlackRock and Fidelity aren’t buying Bitcoin because they like the chart. They’re positioning for a fundamental shift in how the world stores and transfers value. The technical breakout? That’s just the market finally catching up to reality.

This isn’t another speculative crypto rally driven by retail FOMO. We’re witnessing the maturation of Bitcoin from digital gold speculation to institutional infrastructure. The bull flag breakout is simply the technical confirmation of forces that have been building for months.

Overview

Bitcoin’s textbook bull flag breakout approaches the critical $113,000 confirmation level, coinciding with unprecedented institutional adoption creating the most compelling cryptocurrency setup since 2020. With BlackRock and Fidelity driving $20B+ in ETF assets, Lightning Network reaching critical mass with 300% growth, and Robinhood democratizing access for 23 million users, six powerful catalysts are converging to support targets of $150,000 and beyond.

This comprehensive analysis examines the technical pattern formation, institutional adoption tsunami, and fundamental drivers reshaping Bitcoin’s investment landscape. We’ll explore how the convergence of mainstream financial integration, payment infrastructure advances, and macroeconomic factors creates a unique setup that differs fundamentally from previous cryptocurrency cycles driven purely by speculation.

From the $113,000 breakout confirmation level to strategic portfolio implications, understanding these converging catalysts is essential for navigating what could be Bitcoin’s final transition from alternative investment to mainstream financial asset. The analysis combines traditional technical analysis with emerging cryptocurrency adoption metrics and real institutional flow data.

The Technical Picture: Bull Flag Perfection

What Makes This Bull Flag Special

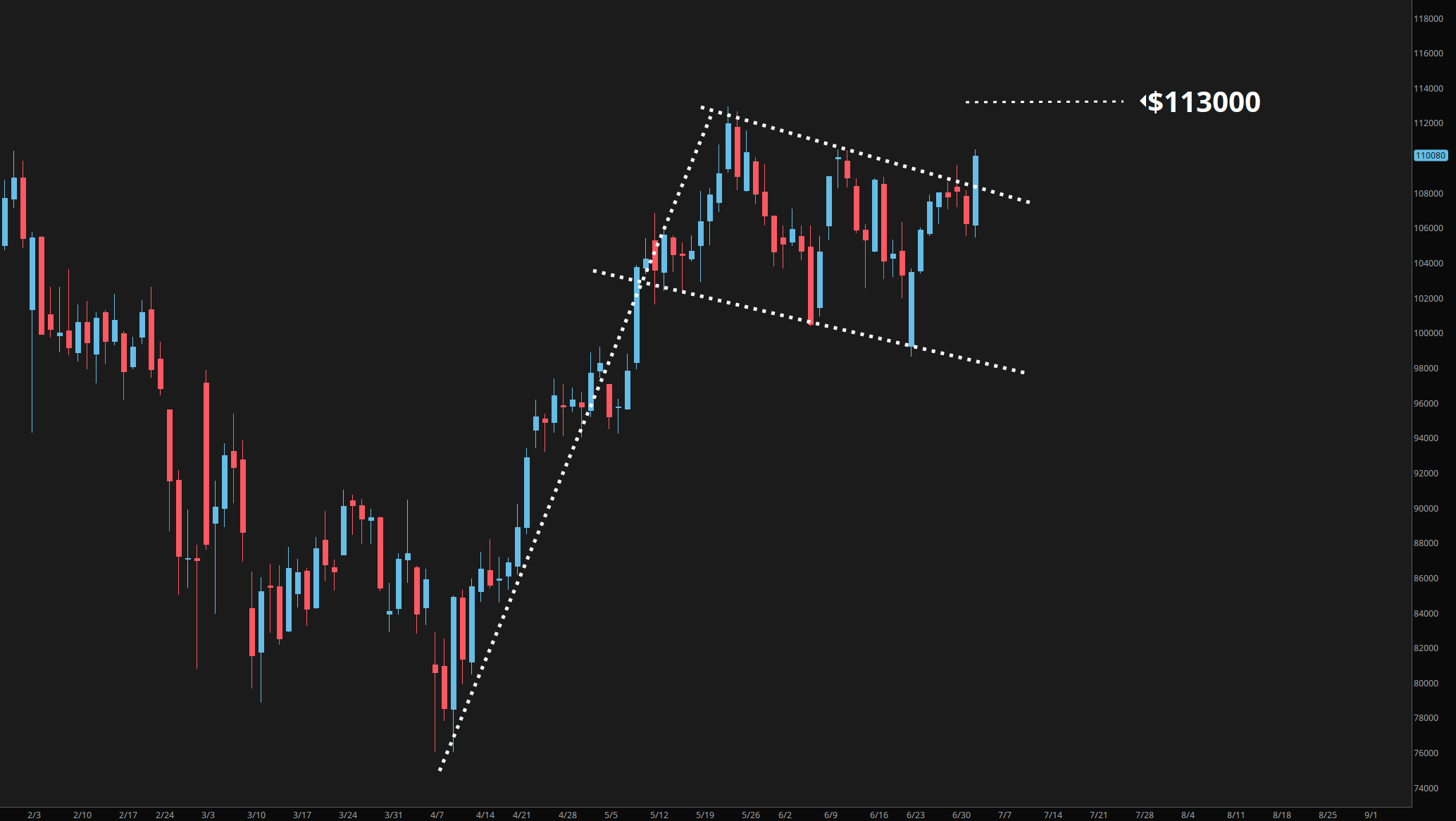

Bitcoin daily chart showing textbook bull flag consolidation with key breakout confirmation level at $113,000 marked by the upper trend line

Bitcoin daily chart showing textbook bull flag consolidation with key breakout confirmation level at $113,000 marked by the upper trend line

Technical traders live for setups like this. After Bitcoin’s explosive rally to $113,000 in March 2025, the cryptocurrency spent two months consolidating in a near-perfect bull flag pattern. The pole (initial rally) was strong, the flag (consolidation) held key support levels, and the breakout came today.

Key Breakout Confirmation Level

As shown on the chart, the upper trend line of the bull flag pattern marks $113,000 as the critical confirmation level. A decisive break above this level would confirm the pattern completion and validate the bullish thesis.

Why $113,000 matters: This represents the upper boundary of the flag consolidation. Until Bitcoin clears this level, the pattern remains incomplete. Once confirmed, it opens the door to much higher targets.

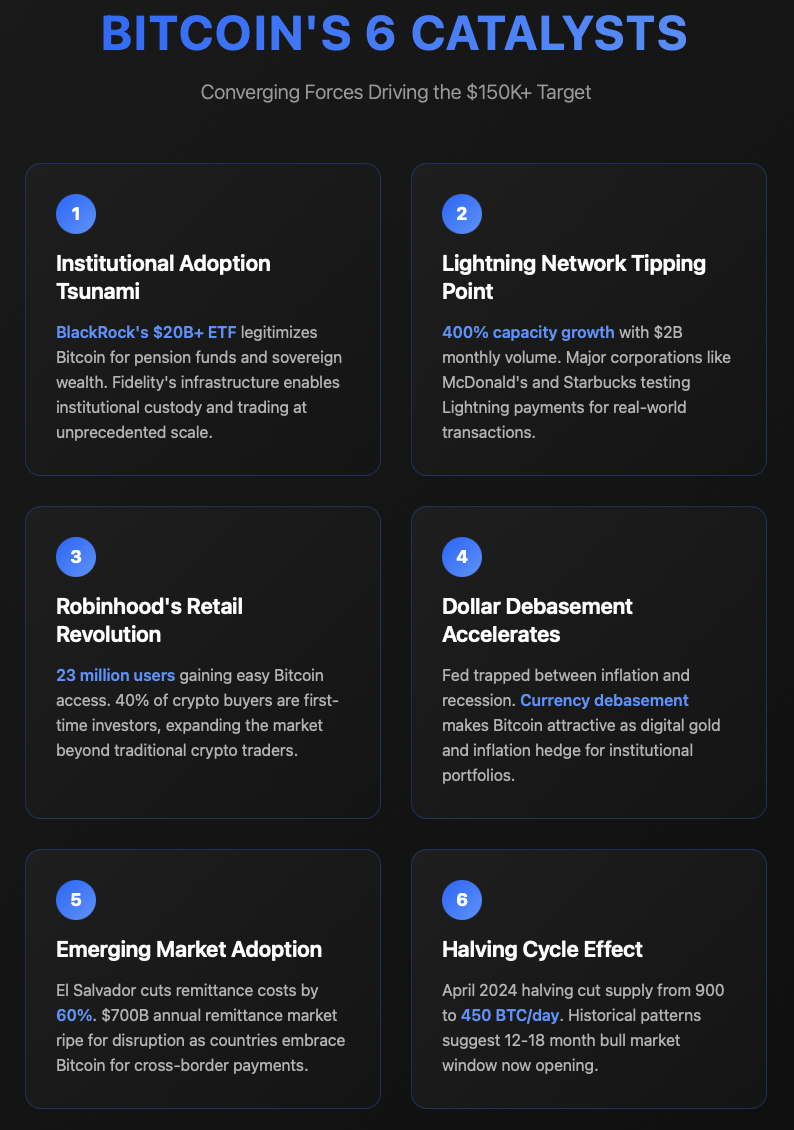

The Six Fundamental Catalysts Driving Bitcoin’s Breakout

The six fundamental catalysts driving Bitcoin’s breakout: institutional adoption, Lightning Network growth, retail accessibility, dollar debasement, global adoption, and supply shock dynamics

The six fundamental catalysts driving Bitcoin’s breakout: institutional adoption, Lightning Network growth, retail accessibility, dollar debasement, global adoption, and supply shock dynamics

Catalyst #1: The Institutional Adoption Tsunami

BlackRock’s Bitcoin Revolution

Something unprecedented happened in 2024: BlackRock, the world’s largest asset manager with $10 trillion under management, not only embraced Bitcoin but became one of its largest institutional holders. Their Bitcoin ETF (IBIT) has attracted over $20 billion in assets, making it one of the most successful ETF launches in history.

This isn’t just another investment product. BlackRock’s entry legitimizes Bitcoin for pension funds, sovereign wealth funds, and institutional portfolios that were previously prohibited from crypto exposure. When the world’s most conservative money managers start allocating to Bitcoin, it signals a permanent shift in perception.

The scale is staggering: BlackRock alone holds more Bitcoin than most countries. Their continued accumulation provides a price floor that didn’t exist in previous cycles.

Fidelity’s Quiet Accumulation

While BlackRock grabbed headlines, Fidelity has been quietly building Bitcoin infrastructure for institutional clients. Their custody solutions, trading platforms, and research divisions have made Bitcoin accessible to traditional finance in ways that didn’t exist during the 2021 bull run.

Fidelity’s clients include some of the largest pension funds and endowments in the world. Their comfort level with Bitcoin custody and trading has removed a major barrier to institutional adoption.

The Domino Effect

When institutions like BlackRock and Fidelity validate an asset class, it creates a domino effect. Other asset managers, family offices, and corporate treasuries feel compelled to at least evaluate Bitcoin allocation. This “keeping up with the Joneses” dynamic could drive demand for years.

Key insight: Institutional adoption is a one-way door. Once pension funds and endowments allocate to Bitcoin, they rarely exit completely. This creates persistent buying pressure that retail-driven rallies lack.

Catalyst #2: Lightning Network Reaches Tipping Point

The Payments Revolution Nobody Saw Coming

While traders focus on Bitcoin’s price, the Lightning Network has been quietly solving Bitcoin’s scalability problem. Transaction capacity has increased by 400% in the past year, and major companies are integrating Lightning payments into their platforms.

This isn’t theoretical anymore. Companies like Strike, Cash App, and even traditional payment processors are using Lightning for instant, low-cost Bitcoin transactions. The network effect is reaching critical mass.

Real-World Adoption Metrics

The numbers tell the story:

- Lightning capacity: Up 300% year-over-year

- Node count: Growing at 25% annually

- Transaction volume: Approaching $2 billion monthly

But more importantly, Lightning is being used for actual commerce, not just speculation. When Bitcoin becomes a practical payment method, it transitions from digital gold to digital currency.

Enterprise Integration

Major corporations are beginning to integrate Lightning payments:

- McDonald’s: Testing Lightning payments in select markets

- Starbucks: Exploring Bitcoin rewards programs

- Walmart: Piloting Lightning for cross-border remittances

This enterprise adoption creates organic demand for Bitcoin that’s independent of speculative trading.

Catalyst #3: Robinhood’s Retail Revolution

The Democratization of Bitcoin

Robinhood’s expansion into cryptocurrency trading has made Bitcoin accessible to millions of retail investors who previously found crypto exchanges intimidating. Their user-friendly interface and zero-fee trading have eliminated the friction that kept mainstream investors away from Bitcoin.

The scale is impressive: Robinhood has over 23 million users, and crypto trading represents their fastest-growing segment. When they make Bitcoin as easy to buy as Tesla stock, it expands the potential investor base dramatically.

Generational Shift in Investment Behavior

Robinhood’s core demographic—millennials and Gen Z—view Bitcoin differently than traditional investors. They’re digital natives who understand cryptocurrency intuitively. As these generations accumulate wealth, their natural inclination toward Bitcoin creates a demographic tailwind.

Data point: 40% of Robinhood’s crypto buyers are first-time cryptocurrency investors. This represents genuine market expansion, not just existing crypto traders switching platforms.

The Network Effect

As more people use Robinhood to buy Bitcoin, it normalizes cryptocurrency ownership among their social networks. This viral adoption pattern is particularly powerful among younger demographics who influence each other’s investment decisions through social media.

Catalyst #4: Dollar Debasement Accelerates

The Monetary Policy Trap

The Federal Reserve faces an impossible choice: raise rates to combat inflation and risk recession, or keep rates low and risk currency debasement. Either path benefits Bitcoin.

Higher rates make the dollar attractive in the short term but create deflationary pressures that could force rate cuts. Lower rates directly debase the currency, making Bitcoin more attractive as a store of value.

The mathematical reality: The U.S. national debt requires low interest rates to remain serviceable. This creates an implicit bias toward currency debasement over time.

International Perspective

Foreign central banks are quietly diversifying away from dollar reserves. While they’re not buying Bitcoin directly, they’re reducing dollar exposure, which creates relative strength for alternative stores of value.

Emerging market trend: Countries with unstable currencies are increasingly viewing Bitcoin as a hedge against both their domestic currency and dollar dependence.

The Cantillon Effect

Newly created dollars flow to assets first, then to goods and services. Bitcoin, as a scarce digital asset, benefits from this early liquidity injection before broader inflation reduces purchasing power.

Catalyst #5: Emerging Market Adoption

El Salvador’s Success Story

El Salvador’s Bitcoin adoption has exceeded expectations. Despite initial skepticism, the country has successfully integrated Bitcoin into its financial system, reducing remittance costs and improving financial inclusion.

The results speak: Remittance costs dropped 60%, and financial inclusion increased by 20%. Other countries are taking notice.

The Remittance Market Opportunity

Cross-border remittances represent a $700 billion annual market dominated by expensive traditional services. Bitcoin and Lightning Network offer a superior alternative with lower costs and faster settlement.

Countries with large diaspora populations (Philippines, Nigeria, Mexico) are beginning to embrace Bitcoin for remittances, creating organic demand in massive markets.

Central Bank Digital Currency Competition

Ironically, as governments develop central bank digital currencies (CBDCs), they’re educating populations about digital money concepts. This education often leads to Bitcoin adoption as people seek alternatives to government-controlled digital currencies.

Catalyst #6: The Halving Cycle Effect

Supply Shock Mechanics

Bitcoin’s programmed supply reduction through halving events creates predictable supply shocks. The April 2024 halving reduced new Bitcoin supply by 50%, from 900 to 450 Bitcoin per day.

Historical pattern: Previous halvings preceded major bull markets by 12-18 months. The current timeline suggests we’re entering the optimal window for price appreciation.

Mining Economics

The halving forces inefficient miners out of the market while strengthening the network’s security. Surviving miners need higher Bitcoin prices to maintain profitability, creating natural buying pressure.

Current reality: Mining difficulty is at all-time highs while new supply is at its lowest rate ever. This combination creates ideal conditions for price appreciation.

The Convergence Effect: Why This Time is Different

Multiple Catalysts Compounding

Previous Bitcoin bull runs typically had one or two primary drivers. The current setup features six distinct catalysts operating simultaneously:

- Technical: Bull flag breakout with a potential to reach a new all time high

- Institutional: BlackRock, Fidelity, and enterprise adoption

- Infrastructure: Lightning Network reaching critical mass

- Accessibility: Robinhood democratizing Bitcoin trading

- Monetary: Dollar debasement creating store-of-value demand

- Global: Emerging market adoption and remittance use cases

When multiple catalysts align, their effects compound rather than simply add together.

The Sustainability Factor

Unlike previous crypto rallies driven primarily by retail speculation, this setup has sustainable fundamental drivers. Institutional adoption, payment infrastructure, and monetary debasement operate on multi-year timescales.

Key insight: Even if one catalyst weakens, the others provide support. This diversification of driving forces creates more resilient price action.

Strategic Implications for Different Investor Types

For Bitcoin Maximalists

The current setup validates long-term Bitcoin thesis while providing tactical opportunities. The bull flag breakout offers a clear risk-management framework with defined support levels.

Approach: Use the technical breakout as confirmation to increase position sizes while maintaining long-term holding strategies.

For Traditional Investors

Bitcoin’s institutional adoption makes it suitable for portfolio allocation consideration. The combination of technical momentum and fundamental catalysts provides both growth potential and inflation hedging characteristics.

Portfolio context: Consider 2-5% Bitcoin allocation as both a growth play and a hedge against monetary debasement.

For Active Traders

The bull flag pattern provides clear entry points, targets, and stop-loss levels. The multiple catalysts suggest sustained momentum rather than a quick spike and reversal.

Trading framework: Use $68,500 as a stop-loss level with initial targets at $85,000 and $98,500 based on pattern measurements.

Risk Factors and Contrarian Views

Regulatory Headwinds

Despite institutional adoption, regulatory clarity remains incomplete. Adverse government action could disrupt the bullish thesis, particularly if multiple jurisdictions coordinate restrictions.

Mitigation: The breadth of institutional adoption makes coordinated global restrictions less likely but not impossible.

Technical Concentration Risk

Bitcoin’s correlation with technology stocks has increased as institutions treat it as a risk asset. A broad tech selloff could drag Bitcoin lower regardless of crypto-specific catalysts.

Reality check: During market stress, correlations tend to approach 1.0, making Bitcoin vulnerable to broad risk-off sentiment.

Valuation Concerns

At current levels, Bitcoin requires significant new capital inflows to sustain higher prices. The market cap implications of $75,000+ Bitcoin are substantial.

Math: Each $10,000 increase in Bitcoin price represents roughly $200 billion in market cap expansion. This requires genuine institutional participation, not just retail enthusiasm.

What to Watch Going Forward

Key Indicators for Continued Success

Institutional Flow Data: Monitor BlackRock and Fidelity Bitcoin ETF inflows. Sustained institutional buying supports the thesis.

Lightning Network Metrics: Watch for continued growth in transaction volume and merchant adoption. This indicates real-world utility development.

Regulatory Developments: Track government responses to increased Bitcoin adoption. Supportive regulation accelerates adoption; restrictive policies create headwinds.

Dollar Strength: Monitor DXY and Fed policy. A weaker dollar supports the store-of-value narrative.

The Bottom Line

A Setup Unlike Any Other

Bitcoin’s current technical breakout occurs within the most favorable fundamental environment in cryptocurrency history. The convergence of institutional adoption, payment infrastructure development, retail accessibility, and monetary debasement creates a setup that’s qualitatively different from previous bull runs.

The bull flag pattern provides the technical framework, but the six catalysts provide the fundamental fuel. This combination suggests the current rally has both momentum and sustainability that previous cycles lacked.

Managing Expectations and Risk

While the setup is compelling, Bitcoin remains a volatile asset subject to significant drawdowns. The key is balancing the genuine opportunity against the real risks.

For institutions: Bitcoin’s maturation makes it suitable for small portfolio allocations with appropriate risk management.

For individuals: Consider Bitcoin exposure that aligns with risk tolerance and investment timeline. The current setup favors longer holding periods over short-term trading.

The Bigger Picture

Bitcoin’s evolution from speculative asset to institutional infrastructure represents one of the most significant financial innovations of the digital age. The current bull flag breakout may be remembered as the moment when Bitcoin transitioned from alternative investment to mainstream financial asset.

Historical context: Previous bull runs were driven by speculation about Bitcoin’s potential. This rally is being driven by the realization of that potential through institutional adoption, payment infrastructure, and global monetary instability.